geothermal tax credit canada

24 A taxpayer may claim CCA only on property described in Schedule II of the Regulations that was acquired for the purpose of earning income. Ontario Rebates and Incentives.

Heat Pump Rebates In Various Canadian Provinces

900 to 1250 for condensing storage or tankless water heaters.

. On a 100-point EnerGuide rating scale if your home is built to exceed a rating of 80 you will receive a 1500 rebate. The Alberta Government and Climate Change Central have made available up to 10000 for new energy efficient homes. The Saskatchewan Home Renovation Tax Credit can only be claimed on your 2021 and 2022 personal income tax returns for qualifying expenses in excess of a 1000 base amount annually.

And if it exceeds 86 you will receive. And if it exceeds 86 you will receive. The credit is equal to 26 of the eligible system costs including the heat pump ground loop field etc.

In Ontario several different groups including Enbridge Gas Distribution Hydro One Independent Electricity System Operator Ontario Electricity Support Program and Toronto Hydro offer rebates and incentives. In December 2020 the tax credit for geothermal heat pump installations was extended through 2023. A 10 tax credit on the purchase and installation of all equipment used to convert solar energy into electricity.

For tax years starting before July 1 2023 manufacturers can also claim an 8 tax credit on the. If the rating is 82 you will receive a 3000 rebate. Adjusted cost means an amount equal to 125 of the manufacturers cost of manufacturing the heat pump.

Serving Canadas geothermal community by stimulating technology transfer knowledge exchange and information transmission it seeks to promote innovation in Canada in the field of. Alberta Financial Incentives to go Geothermal. A grouping of incentives related to energy efficiency from provincialterritorial governments major Canadian municipalities and major electric and gas utilities are offered below.

In a massive environmentally-focused year-end bill congress announced on December 21 2020 that they would extend its federal tax credit for residential ground source heat pumps GSHP installed before 12312022. Eligible grants for my home retrofit. The incentive will be lowered to 22 for systems that are installed in 2023 so act quickly to save the most on your installation.

Free for Geothermal Canada members see member email for promocode. A 10 tax credit on the purchase and installation of all equipment used to convert solar energy into electricity. 2021 Provincial Tax Return Up to 12000 can be claimed for eligible costs incurred from October 1.

The tax credit can be claimed through the income tax system either on the individual T1 income tax return or the corporate T2 income tax return. For general information relating to CCA refer to Income Tax Folio S3-F4-C1 General Discussion of Capital Cost Allowance and the CRA web page Claiming capital cost allowance CCA. For example Enbridge Gas Distribution offers homeowners up to 2000 to cover the cost of a home.

The Geothermal Tax Credit covers expenses including labor onsite preparation assembly equipment and piping or wiring to connect a system to the home. Apply for the Canada Greener Homes Grant. Get a valid piece of government-issued ID with your.

Property is usually considered to be placed in service when installation is complete and equipment is ready for use. Energy Star Compliance Certificate. Find out more about this tax measure on the Government of Manitoba website.

400 for a condensing furnace. The 26 federal tax credit was extended through 2022 and will drop to 22 in 2023 before expiring altogether so act now for the most savings. Provide a reporting basis that is satisfactory to investors shareholders and capital markets such as the Canadian Securities Exchanges in a similar manner that existing Canadian instruments provide for the reporting of Mineral and Petroleum.

Geothermal - a 75 tax credit on the purchase of a geothermal heat pump and a 15 tax credit on the cost of installation. Check Out The Residential Tax Incentive Guide. Free for Geothermal Canada members see member email for promocode.

A 75 tax credit on geothermal heat pumps that are manufactured in Manitoba for use in Manitoba plus a 15 tax credit on the remainder of the capital costs of the geothermal system excluding the heat pump if the installer is certified by the Manitoba Geothermal Energy Alliance Inc. 1200 to 9000 for a condensing boiler or high-efficiency seasonalnon-seasonal boiler. The Code published in was prepared by the Canadian Geothermal Code Committee and published 2010 with the primary objectives to.

Geothermal Canada is a not-for-profit organization committed to advancing science and promoting geothermal research and development in Canada. The total credit you can claim depends on the tax year. The tax credit decreases to 26 in 2020 and 22 in 2021.

Access to all 16 lectures is included with a Geothermal Canada membership 40year. As long as your system is up and running by the end of 2020 you can claim the 26 percent from your federal income taxes. The bill was signed into law on December 27 by president Donald Trump.

A 26 federal tax credit for residential ground source heat pump installations has been extended through December 31 2022. The tax credit applies for geothermal installations in new and existing homes. Homeowners who install geothermal can get the tax credit simply by filling out a form declaring the amount you spent when you file your federal income taxes.

Book your post-retrofit EnerGuide evaluation and apply for the grant. Find out if the initiative is right for you. GREEN ENERGY EQUIPMENT TAX CREDIT A refundable Manitoba tax credit is available for the installation of eligible geothermal equipment to most residential and commercial buildings.

A 10 tax credit on the purchase and installation of all equipment used to convert solar energy into electricity. 48 of the tax code under Sec. 100000 10000 2 95000.

Manufacturers can claim a 75 tax credit on the adjusted cost of geothermal heat pump systems that meet the standards set by the Canadian Standards Association. The credit will lower to 22 in 2023 and for commercial.

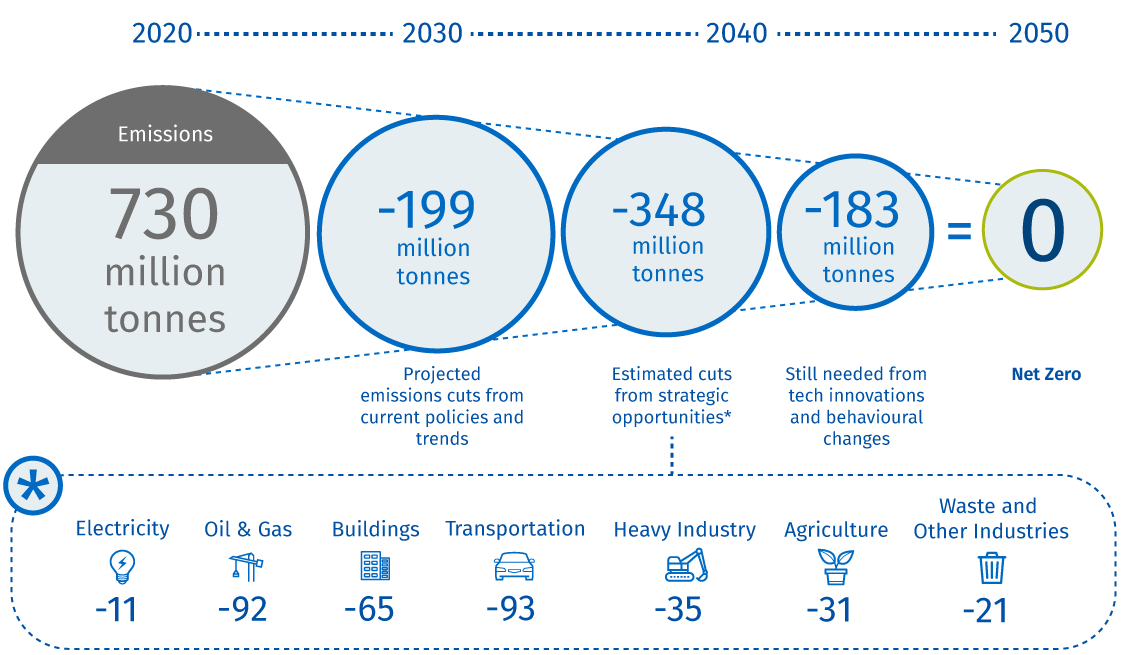

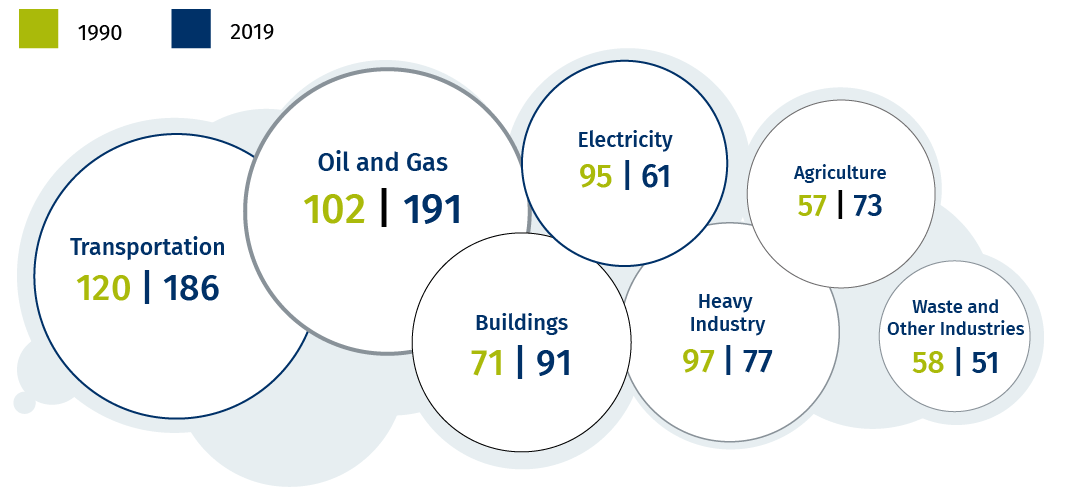

The 2 Trillion Transition Canada S Road To Net Zero

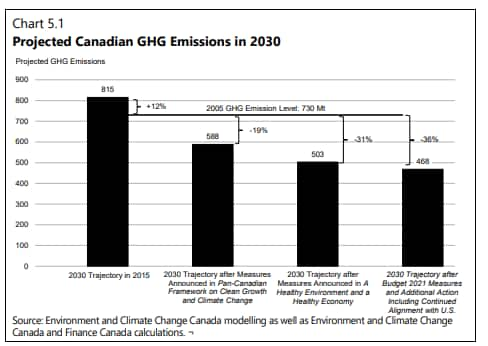

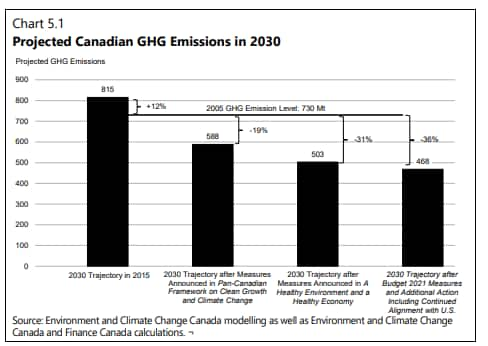

Canada S Fy2021 22 Budget Includes Big Green Investments Indication Of Additional Ghg Emissions Cuts Ihs Markit

Heat Pump Rebates Available Options Maritime Geothermal

Canada Greener Homes Grant 2021 How To Apply Step By Step Ecohome

Minnesota Google Images Minnesota Minnesota State Moorhead Minnesota

Canada S Fy2021 22 Budget Includes Big Green Investments Indication Of Additional Ghg Emissions Cuts Ihs Markit

Fox News Solar Only Works In Germany Because It Gets More Sunlight Than The Us False Solar Energy Facts Solar Power Solar Power System

Incentives Grants Geosmart Energy

2022 Government Heating Cooling System Rebates Furnaceprices Ca

The 2 Trillion Transition Canada S Road To Net Zero

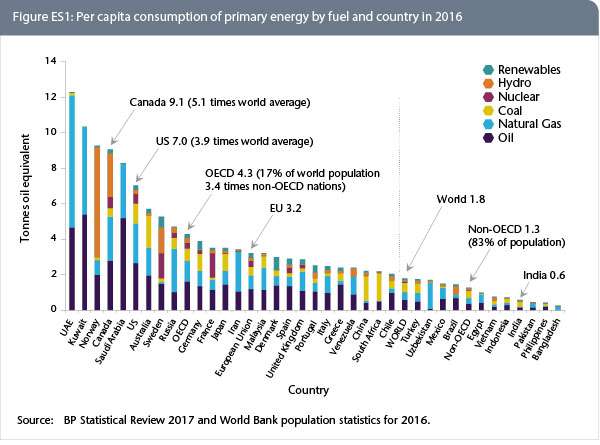

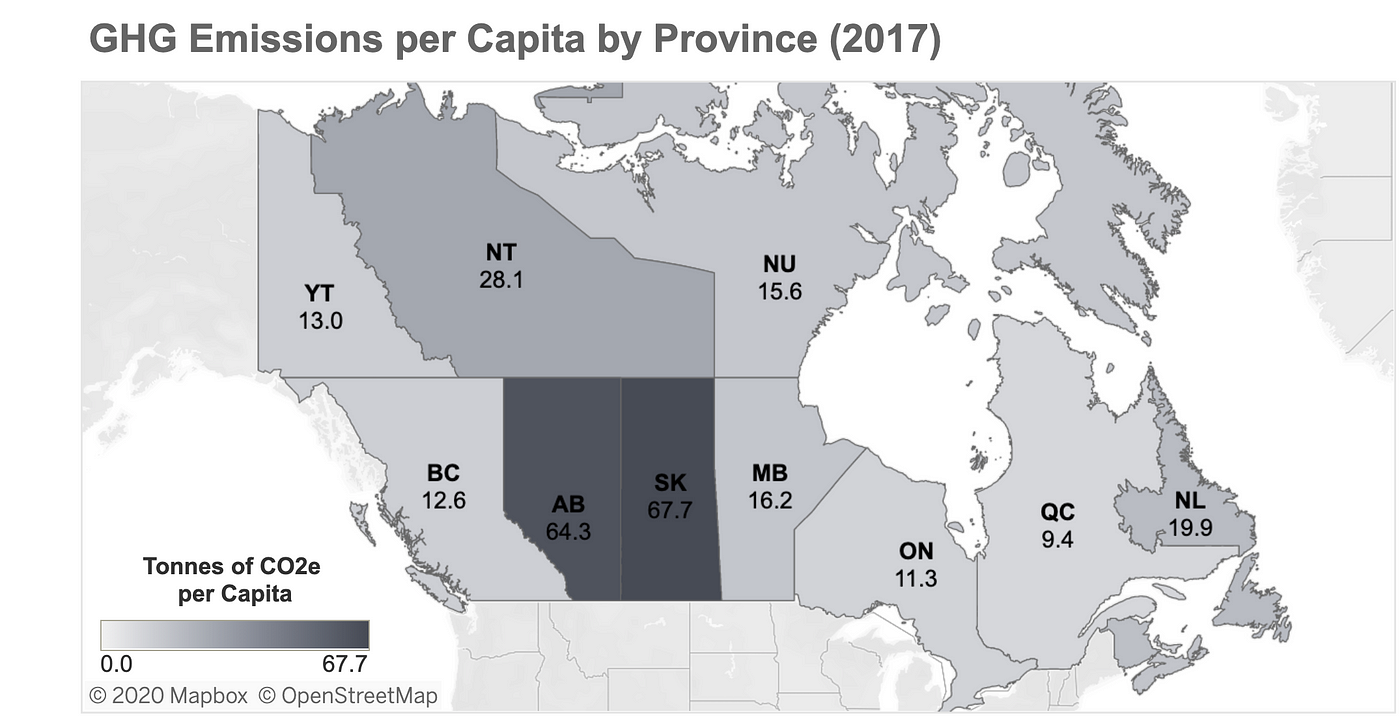

Even Oil Country Will Respond To A Price On Carbon By Michael Barnard The Future Is Electric Medium

August 4 2021 If You Re Debating Adding Solar Panels To Your Business Or Home You Ve Probably Heard Solar Energy For Home Solar Power House Residential Solar

Canada S Budget 2022 Calls For C 3 8b To Launch Critical Minerals Strategy Green Car Congress

Late Summer By The Lake Beautiful Nature Lake Science And Nature

Heat Pump Rebates In Various Canadian Provinces

How To Insulate Your Home Infographic Visual Ly Infographic Real Estate Infographic Insulation

7 Best Canadian Renewable Energy Stocks For Green Investors 2022

Tennessee Tennessee Map Geography For Kids

Today Is National Ceiling Fan Day Nfcd Which Promotes Reduced Energy Consumption Energystar S Tip For Today Rev Warm Air Today Is National Ceiling Fan